IBI Group Inc. Announces Q4 and Year End 2020 Results

Date

March 11, 2021Download PDF

- Organic revenue growth of over 4%

- 5% Adjusted EBITDA1 net of IFRS 16 margin

- Net debt1 to Adjusted EBITDA multiple reduced to 1.3 times

- 18% growth in backlog to $578 million or 18 months

Toronto, Ontario – March 11, 2021 – IBI Group Inc. (“IBI” or the “Company”), a globally-integrated, technology-driven design firm, today announced its financial and operating results for the three and twelve months ended December 31, 2020. Select financial and operational information is outlined below and should be read with IBI’s audited consolidated financial statements (“Financial Statements”) and management’s discussion and analysis (“MD&A”) as of December 31, 2020, which are available on SEDAR at www.sedar.com and on IBI’s website at www.ibigroup.com.

IBI’s 2020 results reflect true organic growth across the firm and were achieved amid the ongoing impact of a global pandemic. Net revenue grew by 4% year-over-year to $393.2 million and exceeded the Company’s previously stated guidance target by 2%, while contributing to a net revenue compound annual growth rate of 6% since 2013. IBI successfully delivered on its year-end 2020 goal of Intelligence representing 20% of net revenue with Adjusted EBITDA1 as a percentage of net revenue totaling 20%. Through the year, the Company continued investing in new technologies, services and solutions designed to advance the firm’s technology pivot. IBI is very pleased to be hosting the Company’s inaugural capital markets focused session for members of the professional investment community within the digital twin of the Smart City Sandbox on March 24, 2021, which will include an environmental, social and governance profile plus an update on the four streams of the Company’s strategic tech pivot. The full virtual experience will be made available to all interested parties after March 24.

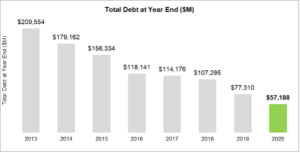

“I am extremely proud of IBI’s accomplishments through 2020 as we executed our strategy while demonstrating resilience, innovation and entrepreneurialism in a remote working environment. In a period when many peer companies are contracting, IBI generated real organic growth, grew our backlog to 18 months and brought our DSO down to 63 days, owing to our unique technology-focused business model and our diverse business and geographic segments,” said Scott Stewart, Chief Executive Officer of IBI Group Inc. “We also reduced net debt to Adjusted EBITDA1 down to 1.3 times, the lowest level realized over the past eight years and well under our target of 2.0 to 2.5 times, achieved while executing the acquisition of Cole Engineering. IBI has set the stage financially and operationally to generate organic and strategic growth, while also improving margins as we continue the pivot to becoming a technology-driven design firm.”

Highlights:

- Net revenue in 2020 of $393.2 million grew 4% over 2019 and exceeded IBI’s guidance of $386 million, reflecting true organic growth and strong performance despite the global pandemic. Q4 2020 net revenue totaled $98.6 million, 8% higher than the same period the prior year.

- Adjusted EBITDA1 net of IFRS 16 impacts totaled $61.0 million or 15.5% of net revenue, a 6% increase over 2019, and for the fourth quarter of 2020 was $13.7 million or 13.9% of net revenue, growing 27% relative to Q4 2019. Consistent with industry peers, IBI intends to report Adjusted EBITDA1 net of IFRS 16 impacts going forward.

- Backlog across the firm was a record 18 months or $578 million at year-end 2020, 18% higher than 2019, reflecting an improved pace of securing future work. Across the Company’s three main business practices of Intelligence, Buildings and Infrastructure, backlog increased by 5%, 20% and 27%, respectively.

- Intelligence net revenue was $79.5 million or 20.2% of total net revenue in 2020, an increase of 16% over 2019, reflecting the success of the Company’s strategic pivot to technology. Adjusted EBITDA1 from Intelligence was $16.1 million, or 20.2% of net revenue, a 59% increase over 2019. Compared to Q4 2019, net revenue from Intelligence grew by 7% to $19.0 million in Q4 2020, and Adjusted EBITDA1 grew 89% to $5.1 million, representing 26.8% of net revenue.

- Billing to clients related to recurring software support and maintenance in 2020 totaled $20.6 million, growing 1.5% over 2019, related to additional clients and subscriptions obtained subsequent to December 31, 2019.

- IBI’s Buildings practice recorded net revenue of $200.8 million in 2020 and $50.8 million in Q4 2020, 2% and 15% higher than the same periods in 2019. Adjusted EBITDA1 was $32.6 million or 16.2% of net revenue in 2020 and $9.6 million or 18.9% of net revenue in Q4 2020, reflecting growth of 5% and 380% relative to the same periods in 2019.

- The Infrastructure practice generated net revenue of $112.1 million in 2020 and $28.5 million in Q4 2020, 1% higher and 4% lower than the respective periods in 2019. Adjusted EBITDA1 of $9.9 million or 8.8% of net revenue in 2020 and $1.5 million or 5.1% of net revenue in Q4 2020 were 14% and 58% lower than the same periods in 2019, respectively.

- Net income from operating activities1 was $17.5 million in 2020 and $0.5 million in Q4 2020, reflecting declines of 20% and 76%, respectively, relative to the same periods the previous year, largely due to payments on lease liabilities. Basic and diluted earnings per share from operating activities1 in 2020 totaled $0.47 and $0.46, respectively, and was $0.01 (basic and diluted) in Q4, 2020.

- Net income in 2020 totaled $17.7 million ($0.47 per basic and diluted share), compared to $16.8 million in 2019 and a loss of $0.9 million ($0.02 per basic and diluted share) in Q4 2020, primarily due to the accelerated accretion associated with IBI issuing an early notice of redemption on its 5.5% debentures.

- Cash flows provided by operating activities totaled $53.7 million in 2020 and $20.4 million in Q4 2020, compared to $50.2 million and $32.0 million in the same periods in 2019, with the decline in Q4 2020 attributable to a decrease in non-cash working capital.

- IBI’s days sales outstanding (“DSO”) of 63 days at December 31, 2020 was one day lower than at the end of 2019 and positions the Company as one of the leaders in DSO among its peers, reflecting IBI’s continued diligence in reviewing contract assets and accounts receivable and its commitment to accelerated billings.

- Net debt1 at year-end 2020 totaled $57.2 million, resulting in a 1.3 times net debt to trailing 12 months’ Adjusted EBITDA1 ratio, demonstrating the success of IBI’s efforts to direct free cash flow to debt reduction and position the Company for continued potential growth organically and through acquisitions.

Financial Highlights

(in thousands of Canadian dollars except per share amounts)

| THREE MONTHS ENDED | YEAR ENDED | |||||

| DECEMBER 31, | DECEMBER 31, | |||||

| 2020 | 2019 | 2020 | 2019 | |||

| Number of working days | 63 | 63 | 252 | 251 | ||

| Gross revenue |

$ 135,641 |

$ 114,203 |

$ 505,077 |

$ 460,458 |

||

| Less: Subconsultants and direct costs |

37,058 |

22,523 |

111,867 |

83,605 |

||

| Net revenue |

$ 98,583 |

$ 91,680 |

$ 393,210 |

$ 376,853 |

||

| Net income |

$ (929) |

$ 1,892 |

$ 17,681 |

$ 16,849 |

||

| Net income from operating activities1 |

$ 461 |

$ 1,955 |

$ 17,532 |

$ 22,015 |

||

| Basic earnings per share |

$ (0.02) |

$ 0.05 |

$ 0.47 |

$ 0.45 |

||

| Diluted earnings per share |

$ (0.02) |

$ 0.05 |

$ 0.47 |

$ 0.45 |

||

| Basic earnings per share from operating activities1 |

$ 0.01 |

$ 0.05 |

$ 0.47 |

$ 0.59 |

||

| Diluted earnings per share from operating activities1 |

$ 0.01 |

$ 0.05 |

$ 0.46 |

$ 0.58 |

||

| Adjusted EBITDA1 net IFRS 16 impacts |

$ 13,679 |

$ 10,824 |

$ 61,026 |

$ 57,522 |

||

| Adjusted EBITDA1 net of IFRS 16 impacts as a percentage of net revenue |

13.9% |

11.8% |

15.5% |

15.3% |

||

| Adjusted EBITDA1 |

$ 10,640 |

$ 6,809 |

$ 45,734 |

$ 42,026 |

||

| Adjusted EBITDA1 as a percentage of net revenue |

10.8% |

7.4% |

11.6% |

11.2% |

||

| Cash flows (used in) provided by operating activities |

$ 20,379 |

$ 31,950 |

$ 53,672 |

$ 50,158 |

||

Notes:

See “Definition of Non-IFRS Measures” in the MD&A.

2020 Year in Review

For the 12 months ended December 31, 2020, IBI successfully met or exceeded all established financial targets and objectives, which are critical components in the successful execution of its strategic technology pivot. With record net revenue and Adjusted EBITDA1, free cash flow and a strong backlog, supported by a strong balance sheet, the Company’s is excited about building on this momentum into 2021 and beyond.

Despite the ongoing COVID-19 global pandemic, IBI posted strong performance across each of the Intelligence, Buildings and Infrastructure practices, along with record revenue and Adjusted EBITDA1. Annual net revenue of $393.2 million is a new record for the Company, while Q4 2020 net revenue totaled $98.6 million, 8% higher than Q4 2019, and 1% higher than the previous quarter. IBI’s 2020 Adjusted EBITDA1 net of IFRS 16 impacts was $61.0 million (15.5% of net revenue), compared to $57.5 million (15.3% of net revenue) in 2019, and was $13.7 million (13.9% of net revenue) in Q4 2020, 27% higher than Q4 2019. Given Adjusted EBITDA1 net of IFRS 16 impacts is the measure reported by its peers, IBI will conform with industry and report on this measure going forward.

In November, IBI purchased the net assets of Cole Engineering Group Ltd (“Cole”) for total purchase consideration of $8.7 million, expanding the Company’s geographic reach while bolstering its capabilities across the water, transportation, urban development and environmental sectors. The acquisition affords IBI strategic advantages given Cole’s complementary water sector consulting and advisory services, including demand modelling and planning; design and construction management for water infrastructure facilities, pipelines and tunnels; as well as operations and maintenance, all of which offer longer-term growth potential for IBI. Subsequent to the end of the quarter, IBI closed the acquisition of Peters Energy Solutions, Inc., enhancing the Company’s capabilities across sustainable community development and its focus on the environment, supporting IBI’s commitment to environmental, social and governance (ESG) practices. In addition to the strategic business benefits offered by these transactions, they also align with the Company’s values, including the principles of stakeholder capitalism.

Consistent with ongoing efforts to strengthen the balance sheet, IBI issued $46.0 million of 6.5% senior unsecured debentures that mature on December 31, 2025 in October, with proceeds earmarked for redemption of the Company’s $46.0 million 5.5% convertible unsecured debentures which mature on December 31, 2021 and have a conversion price of $8.35 per common share. The 5.5% debentures were redeemed early on January 15, 2021 for total consideration of $47.6 million. Since the 6.5% debentures do not have a conversion feature, the historical earnings volatility associated with fair valuing the other financial liabilities associated with the 5.5% convertible debentures will be eliminated, thereby simplifying IBI’s accounting and financial reporting for investors.

At year-end 2020, IBI had successfully reduced net debt to $57.2 million, representing a net debt to trailing 12 months’ Adjusted EBITDA1 multiple of 1.3 times, the lowest level for the Company in the past eight years and well below its target range of 2.0 to 2.5 times. The Company’s disciplined approach has secured significant financial flexibility and with current cash reserves and available credit facility borrowings, IBI is very well positioned to meet existing and future working capital needs.

Business Practice Summary Highlights

Intelligence

IBI is pleased to confirm that its “20 / 20 in 2020” goal has been achieved: the Intelligence practice represented 20.2% of net revenue and generated 20.2% Adjusted EBITDA1 as a percentage of net revenue in 2020. Intelligence net revenue for the year totaled $79.5 million, growing 16% over 2019, while Adjusted EBITDA1 of $16.1 million was 59% higher than in 2019. Fourth quarter 2020 results reflect 7% growth in Intelligence net revenue to $19.0 million, and 89% growth in Adjusted EBITDA1 to $5.1 million (26.8% of net revenue) over Q4 2019.

During 2020, IBI billed $20.6 million to clients related to recurring software support and maintenance, 1.5% higher than in 2019, and in Q4 2020, held levels stable relative to Q4 2019 at $5.3 million. Recurring software support and maintenance contracts remain a long-term focus area for IBI with further growth and evolution anticipated as new products and solutions are added to the Company’s portfolio. With this growth, IBI expects to capture a higher proportion of the ongoing and ‘sticky’ subscription revenue that is generated through the full lifecycle of assets designed by IBI.

IBI’s Intelligence-sector portfolio was bolstered during the year with a contract to deploy a cloud-based solution for the Port Authority of New York and New Jersey (PANYNJ) that can provide airport ground transportation operators with data related to the health of drivers and the cleanliness of their vehicles. In addition, IBI added to its growing software as a service (SaaS) portfolio with a multi-year engagement for its TravelIQ platform with the state of Massachusetts, a contract with New York Department of Transportation to provide traveler information technology through the 511NY platform, and the first location-based mobile app for motorway users in Greece that builds on previous toll and traffic management system work performed by IBI.

In addition to the meaningful revenue and Adjusted EBITDA1 contributions from Intelligence, internally the Company benefits from enhanced productivity associated with various technologies, products and services, such as parametric design and optimization bots that streamline the administrative burden of project set-up so that professionals’ time is freed up to focus on higher-value work.

Buildings

For the year ended December 31, 2020, the Buildings practice represented 51% of IBI’s total net revenue and contributed $200.8 million, 2% higher than in 2019, while Q4 2020 net revenue grew 15% over the same period in 2019 to $50.8 million. Adjusted EBITDA1 for Buildings totaled $32.6 million or 16.2% of net revenue in 2020, 5% higher than 2019, and was $9.6 million in Q4 2020, 380% higher than the same period in 2019.

The Buildings practice remained active through 2020, including work on justice projects in the Canada West segment, leveraging the Company’s cloud-based InForm solution to help with asset management, informed maintenance and planning decisions, and ultimately reduce operational costs. Healthcare in the UK was also a strong contributor to the Buildings practice through the year, as work on a number of hospitals continued. IBI’s urban renewal work in Detroit was focused on planning and design to reinvigorate the city’s core and re-establish its downtown as a centre of activity and vitality. Design and technology integration also continued on a major motor vehicle manufacturing facility in the U.S. Buildings practice.

Infrastructure

Through 2020, IBI’s Infrastructure practice generated net revenue of $112.1 million, representing 29% of total net revenue, 1% higher than in 2019, and in Q4 2020 generated $28.5 million in net revenue, 4% lower than Q4 2019. Annual Adjusted EBITDA1 of $9.9 million represented 8.8% of net revenue, and was 14% lower than 2019, while Q4 2020 Adjusted EBITDA1 was $1.5 million, 5.1% of net revenue, and 58% lower than Q4 2019. The decrease in Q4 2020 Infrastructure results relative to the same period in 2019 is largely due to decreased economic activity in Alberta.

Alongside a joint venture partner, IBI was awarded technical advisor role on the Scarborough and Yonge North Subway Extension Projects during the year, responsible for a broad range of engineering, technical advisory, and other services to support planning, preparation, procurement, and construction of two new rapid transit subway projects planned in the Greater Toronto Area. In addition, IBI was awarded the TTC Line One subway enhancement program during the year and is part of the preferred proponent team for the Broadway Subway transit infrastructure project in Vancouver, British Columbia. The Company’s Infrastructure practice continues to be active on transit projects across Canada and internationally.

2021 Guidance and Outlook

Building on the success and momentum realized through 2020, IBI is pleased to provide a forecast total net revenue projection of approximately $422 million for the year ended December 31, 2021, more than 9% higher than IBI’s 2020 revenue forecasts and a 7% increase relative to 2020 actuals. Realizing this forecast net revenue would represent a 6% compound annual growth rate since 2013.

As a result of the improved pace of securing future work, IBI increased backlog by 18% across the firm relative to December 31, 2019, while backlog increased 5%, 20% and 27% for Intelligence, Buildings and Infrastructure, respectively. IBI currently has approximately $578 million of work committed and under contract for the next five years. Based on the current pace of work that the Company has achieved over the past twelve months ended December 31, 2020, this contracted work equates to approximately 18 months of backlog, the strongest in IBI’s history.

Following a focused and disciplined program of directing free cash flow to debt repayment over the past few years, IBI has been highly successful at reducing total debt and associated debt metrics. With a year end 2020 net debt1 to Adjusted EBITDA1 multiple of only 1.3 times, the Company has exceeded its previously stated target range of between 2.0 and 2.5 times. With $57.2 million of net debt at year end, IBI is strongly positioned to allocate capital toward value enhancement opportunities such as accelerated organic growth, further equity investments in early-stage technologies, and corporate or asset acquisitions.

As a true demonstration of the power of technology, IBI is pleased to confirm that in less than 12 months from announcement to launch, the Company has established a robust and full-featured Digital Engagement Venue in which it can hold virtual meetings, events and other gatherings from a digital twin of IBI’s physical Smart City Sandbox. On March 24th, the Company is planning to host its first ever virtual capital markets event for analysts and members of the professional investment community to explore the Smart City Sandbox and dive deeper into specific projects across IBI’s Intelligence, Buildings and Infrastructure practices. In addition, users can learn more about the Company’s ESG profile, review a summary of year-end 2020 financial results, hear a keynote from CEO, Scott Stewart and get the broader picture from management’s responses to a Q&A session. On March 25th, the experience will be made available to all interested parties, with further details and registration instructions to be disclosed via press release.

Investor Conference Call & Webcast

IBI will host a conference call and live webcast on Friday, March 12, 2021 at 8:30 a.m. ET. During the call, management will present IBI’s financial and operating results followed by a question-and-answer session.

A live audio webcast of this call is available by entering the following URL into your web browser:

https://produceredition.webcasts.com/starthere.jsp?ei=1419428&tp_key=5bd5c0e54b

Conference Call Details:

Date: Friday, March 12, 2021

Time: 8:30 a.m. ET

Dial In: North America: 1-888-390-0546

Dial In: Toronto Local / International: 416-764-8688

Replay: North America: 1-888-390-0541

Replay: Toronto Local / International: 416-764-8677

Replay Passcode: 923079#

A recording of the conference call will be available within 24 hours following the call at the Company’s website. The conference call replay will be available until March 26, 2021.

About IBI Group Inc.

IBI Group Inc. (TSX:IBG) is a technology-driven design firm with global architecture, engineering, planning, and technology expertise spanning over 60 offices and 2,700 professionals around the world. For nearly 50 years, its dedicated professionals have helped clients create livable, sustainable, and advanced urban environments. IBI Group believes that cities thrive when designed with intelligent systems, sustainable buildings, efficient infrastructure, and a human touch. Follow IBI Group on Twitter @ibigroup and Instagram @ibi_group.

For additional information, please contact:

Stephen Taylor, CFO

IBI Group Inc.

55 St. Clair Avenue West

Toronto, ON M5V 2Y7

Tel: 416-596-1930

www.ibigroup.com

Forward-Looking Statements

Certain statements in this news release may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company and its subsidiary entities, including IBI Group Partnership (“IBI Group”) or the industry in which they operate, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this news release, such statements use words such as “may”, “will”, “expect”, “believe”, “plan” and other similar terminology. These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this news release. These forward-looking statements involve a number of risks and uncertainties, including those related to: (i) the Company’s ability to maintain profitability and manage its growth; (ii) the Company’s reliance on its key professionals; (iii) competition in the industry in which the Company operates; (iv) timely completion by the Company of projects and performance by the Company of its obligations; (v) fixed-price contracts; (vi) the general state of the economy; (vii) risk of future legal proceedings against the Company; (viii) the international operations of the Company; (ix) reduction in the Company’s backlog; (x) fluctuations in interest rates; (xi) fluctuations in currency exchange rates; (xii) upfront risk of time invested in participating in consortia bidding on large projects and projects being contracted through private finance initiatives; (xiii) limits under the Company’s insurance policies; (xiv) the Company’s reliance on distributions from its subsidiary entities and, as a result, its susceptibility to fluctuations in their performance; (xv) unpredictability and volatility in the price of common shares of the Company; (xvi) the degree to which the Company is leveraged and the effect of the restrictive and financial covenants in the Company’s credit facilities; (xvii) the possibility that the Company may issue additional common shares diluting existing Shareholders’ interests; (xviii) income tax matters. These risk factors are discussed in detail under the heading “Risk Factors” in the Company’s Annual Information Form. New risk factors may arise from time to time and it is not possible for management of the Company to predict all of those risk factors or the extent to which any factor or combination of factors may cause actual results, performance or achievements of the Company to be materially different from those contained in forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of March 11, 2021.

The factors used to develop revenue forecast in this news release include the total amount of work the Company has signed an agreement with its clients to complete, the timeline in which that work will be completed based on the current pace of work the company achieved over the last 12 months and expects to achieve over the next 12 months. The Company updates these assumptions at each reporting period and adjusts its forward-looking information as necessary.

Non-IFRS Measures

The Company uses certain terms in this news release and within the MD&A, such as ‘adjusted EBITDA’, ‘net income and earnings per share from operating activities’, and ‘working capital measured in number of days of gross billings’ which do not have a standardized or prescribed meaning under International Financial Reporting Standards (IFRS), and, accordingly these measurements may not be comparable with the calculation of similar measurements used by other companies. For a reconciliation of each non-IFRS measure to its nearest IFRS measure, please refer to the “Definition of Non-IFRS Measures” section in the MD&A for applicable definitions, calculations, rationale for use and reconciliations to the most directly comparable measure under IFRS. Non-IFRS measures are provided as supplementary information by which readers may wish to consider the Company’s performance but should not be relied upon for comparative or investment purposes.

[1] Non-IFRS measure. See “Definition of Non-IFRS Measures” in the MD&A.